Piauí, Brazil / Nickel and cobalt

View on map

The project is an open-pit nickel-cobalt mining operation located in the state of Piauí, in north-eastern Brazil.

Development

Nickel and cobalt

Brazilian Nickel

Brazil

Royalty rate and type

1.60%

Balance sheet classification

Royalty financial instrument

Key facts

The Group has a royalty over the Piauí nickel project in Brazil owned by Brazilian Nickel Ltd. Ecora Resources contributed an initial investment of $2.0m for a 1.25% GRR on the project in 2017 and increased this to 1.60% in 2023 through investing a further $7.5m. Ecora has, at its election, the right to increase this investment by a further $62.5m for a total gross royalty of 4.25% upon the satisfaction of certain milestones.

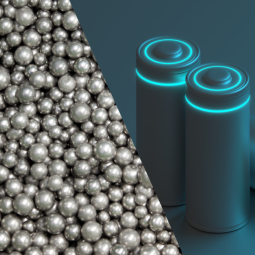

Piauí is a low cost project located in established mining jurisdiction. High purity nickel and cobalt hydroxide products to be produced from Piauí are expected to be used for lithium ion batteries, one of the key end markets for which is electric vehicles.

- Detailed engineering studies were completed and incorporated the learnings from the small-scale plant to optimise the flow sheet ahead of financing discussions for the construction of the project.

- In December, Brazilian Nickel received a letter of interest from the US International Development Finance Corporation (DFC) regarding a loan facility of up to $550m.

- Focus on converting the letter of interest from the DFC into a committed financing facility.

- Advance discussions with potential financing partners ahead of a project Final Investment Decision, expected after 2026.

The Piauí royalty is classified as a royalty financial instrument on the balance sheet. It is carried at fair value by reference to the discounted expected future cash flows over the life of the mine. The option to invest further amounts is also classified as a royalty financial instrument on the balance sheet and carried at fair value. All valuation movements relating to the royalty and the option are recognised directly in the income statement.